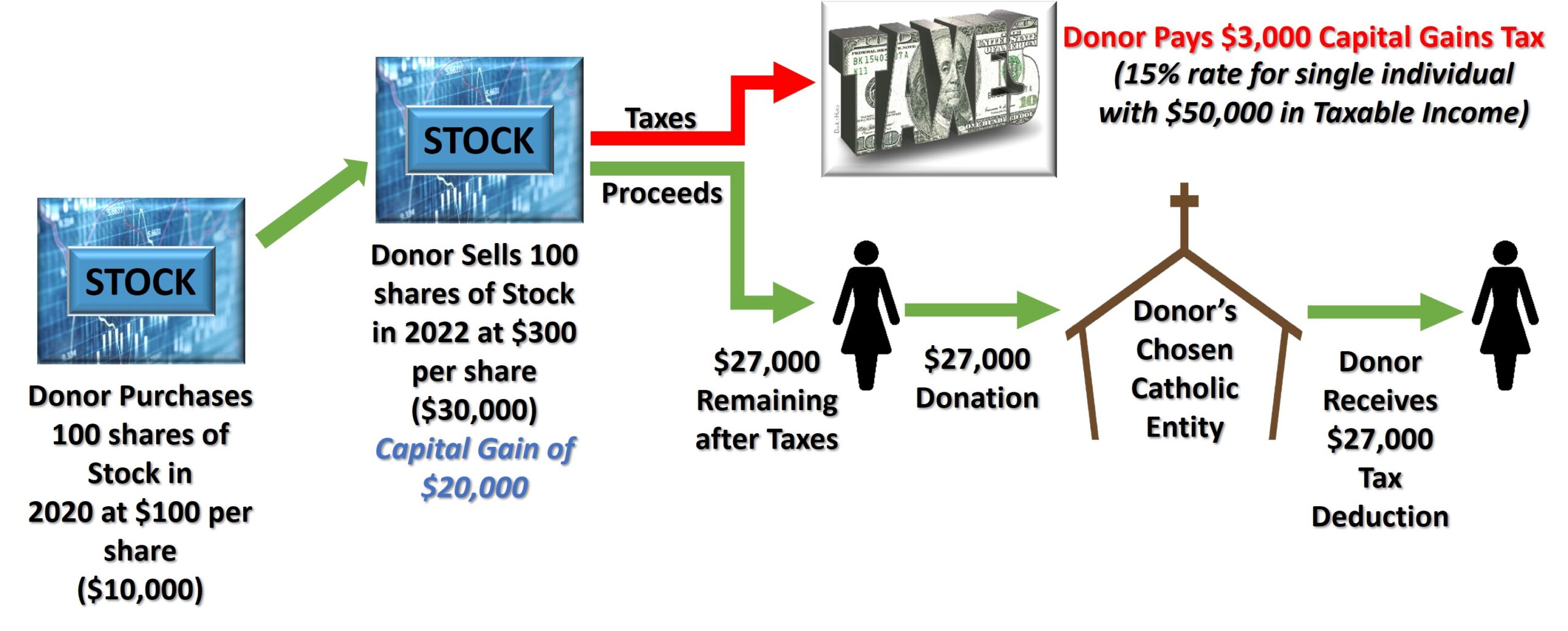

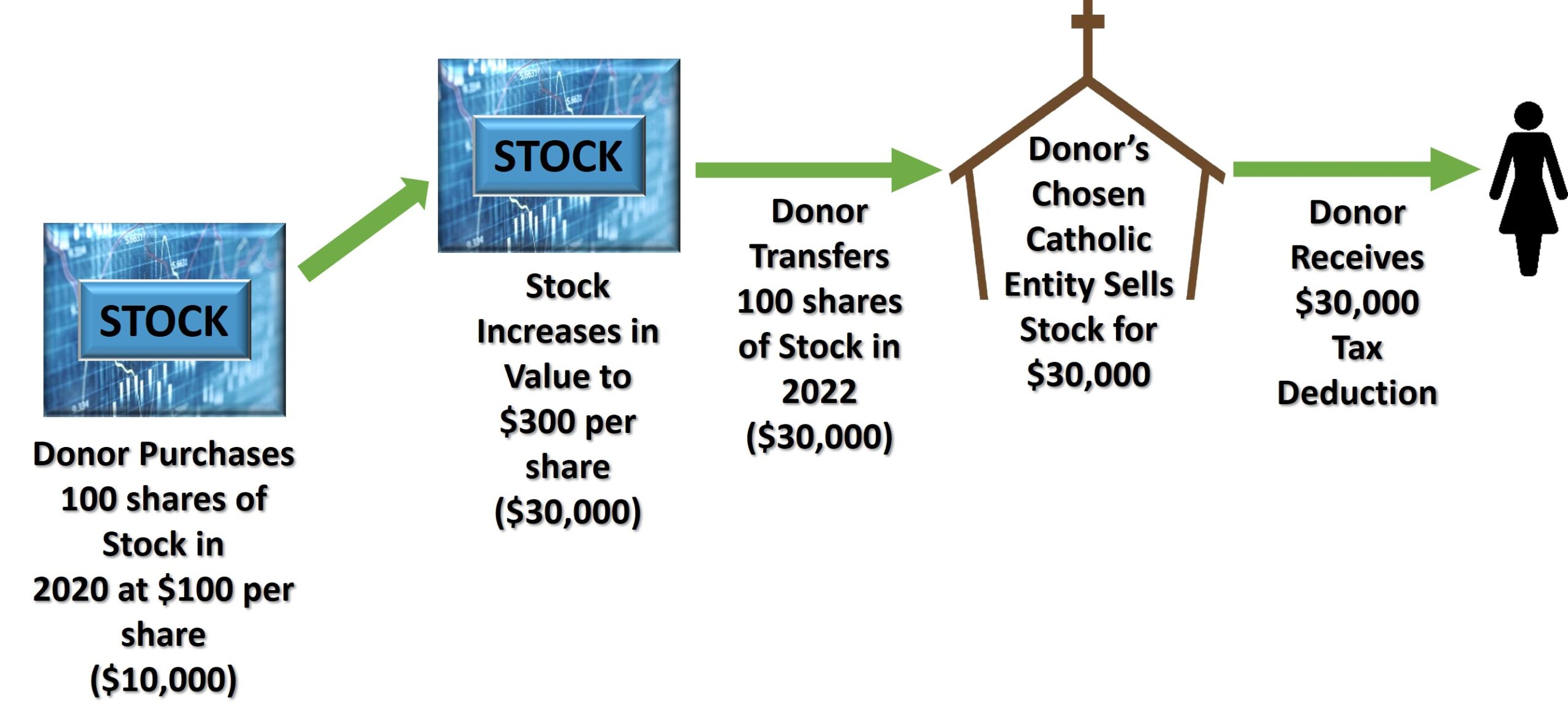

Instead of selling appreciated assets like securities or real estate to make a gift, donors can donate the appreciated asset directly to the Foundation and receive a charitable deduction for the full market value of the asset and pay no capital gains tax on the transfer.

*The Catholic Community Foundation of Southwest Florida does not provide legal, tax or financial advice. When considering gifting options, seek the advice of your own legal, tax and/or financial professionals.